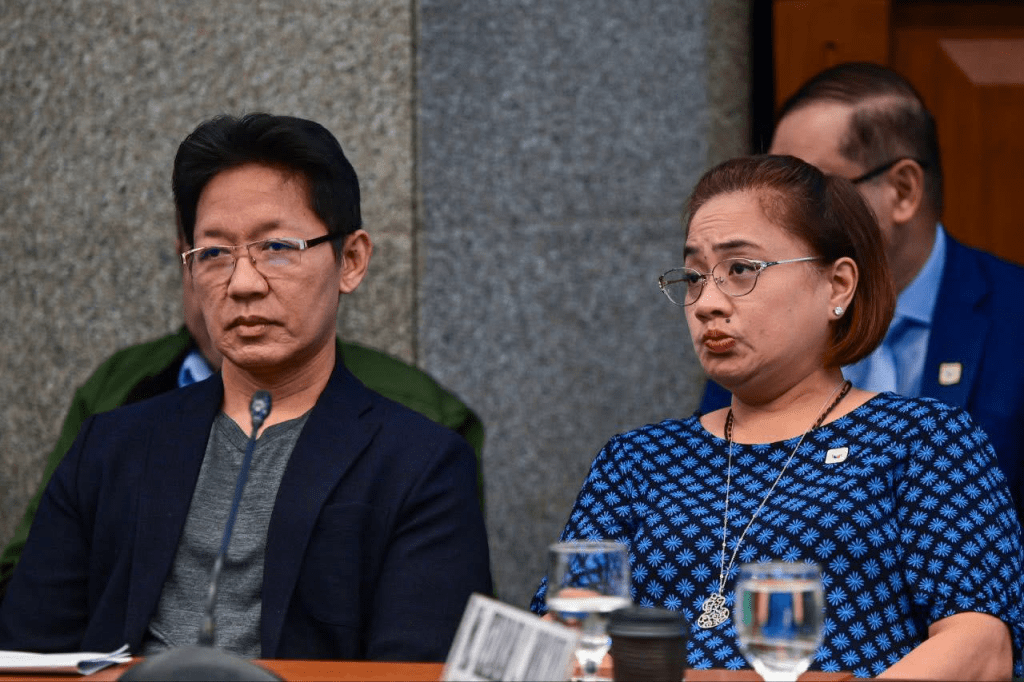

MANILA, Philippines—Senator Pia S. Cayetano rejected a proposed measure seeking to reduce annual excise tax increases on tobacco, vape, and heated tobacco products (HTPs), saying it would harm public health and weaken funding for essential services.

Cayetano made the statement in response to House Bill No. 11360, which seeks to amend current Sin Tax laws by lowering tax hikes on these products.

“Public health must never take a backseat to industry profits,” Cayetano said.

Cayetano said sin taxes are intended to discourage the use of harmful and addictive products, especially among the youth.

She said the Vape Law, passed a year later, removed these protections and contributed to a rise in youth vaping, citing the 2023 National Nutrition Survey by the Food and Nutrition Research Institute, which showed an increase in adolescent vaping from 3.2 percent in 2018–2019 to 39.9 percet in 2023.

“We should not repeat the mistakes of the Vape Law, which stripped away critical regulatory protections established under the Sin Tax Reform Act. We must not allow history to repeat itself,” Cayetano said.

“Reducing taxes clearly does not address the health costs of these sin products, but even adds to them. It also undermines the government’s ability to fund essential health services, including the Universal Health Care program, which heavily relies on sin tax revenues,” she added.

Cayetano also supported the statement of Senate Ways and Means Committee Chair Sherwin Gatchalian that lowering sin taxes is not the solution to illicit trade.

“The goal of our Sin Tax laws has always been clear – to discourage the use of harmful products and protect the health of every Filipino,” Cayetano said.

“We must stay the course and craft policies that will truly prioritize the safety, well-being, and future of every Filipino, especially the youth,” she added.

Leave a comment