MANILA — Malacañang on Thursday said the proposed United States tax on foreign workers’ remittances would have a “minimal” impact on the Philippine economy, but acknowledged that the measure could affect many Filipino families who depend on money sent by relatives abroad.

Citing data from the Department of Finance (DOF), Presidential Communications Office Undersecretary Atty. Claire Castro said that if passed, the proposed tax would only affect around 20 percent of the estimated 4.4 million Filipinos in the US—primarily non-US citizens, including green card holders and working visa holders.

The DOF estimates that the tax, which may take effect by January 2026, could reduce remittances by about $100 million, or just 0.003 percent of the projected $36.5 billion in total remittances that year.

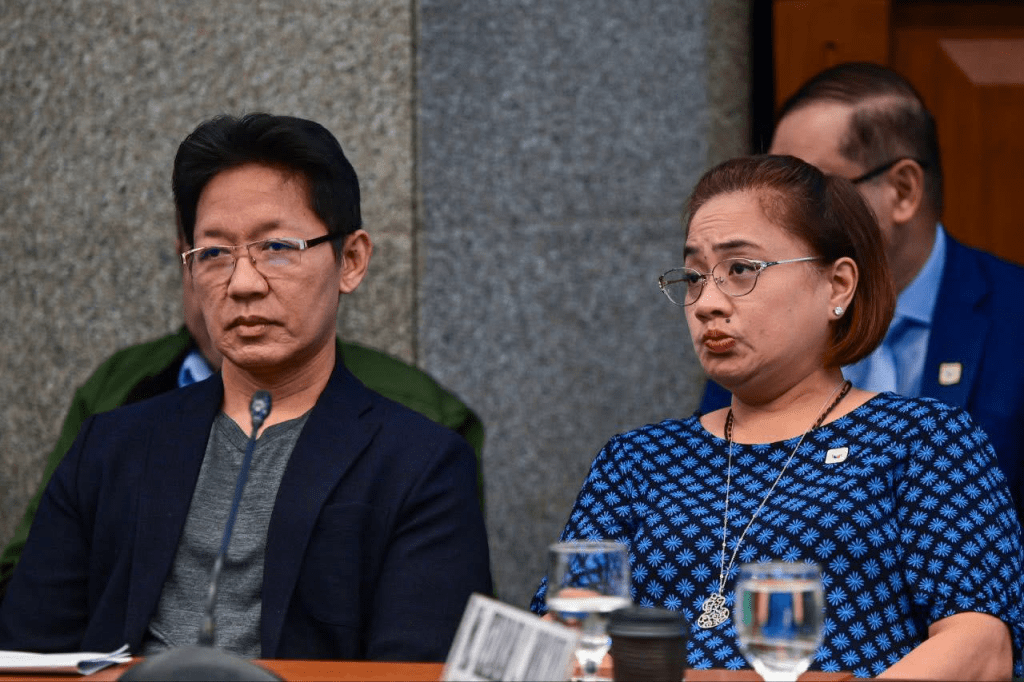

“While the estimated effect is minimal on the economy, it may be substantial for many families who solely rely on remittances from a family member in the US,” Castro said in a Palace briefing.

According to the DOF, a $100 remittance would be taxed around $3.50, meaning families in the Philippines would receive only $96.50.

Castro emphasized that although the broader macroeconomic impact may be limited, the loss of even a few dollars per remittance could hurt families who depend on the money for essential needs such as food, utilities, and medicine.

A 2023 survey by the Bangko Sentral ng Pilipinas showed that about 90 percent of overseas remittances are used for basic household expenses.

The Palace said it continues to monitor developments on the proposed tax measure and is coordinating with concerned agencies to assess its implications on overseas Filipino workers and their families.

Leave a comment