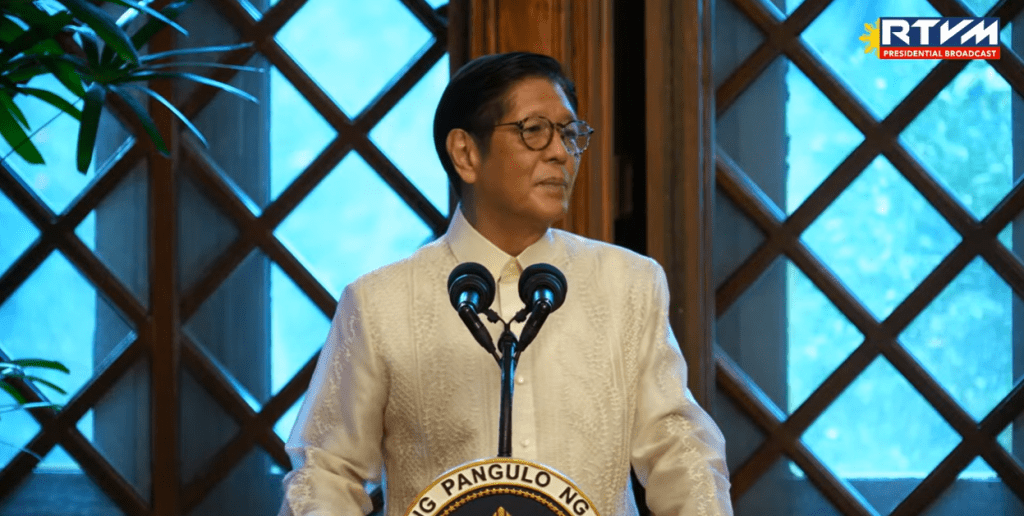

MANILA — Finance Secretary Ralph Recto said the government is studying the imposition of stricter rules and higher taxes to better regulate online gambling in the country.

In a recent informal media chat, Recto said one of the options being considered is increasing the taxes collected from online gaming operators.

“There are many ways of doing it. One is we leave it to PAGCOR (Philippine Amusement and Gaming Corporation). Because PAGCOR, on its own, can increase the fees and charges it collects from online gaming,” he said.

Recto explained that PAGCOR currently imposes a 30-percent fee on electronic gaming, while the Bureau of Internal Revenue (BIR) collects an additional 5 percent.

“The total is about 38 percent of the gross gaming revenue is actually taxed. We may increase that even further. That’s one. We’re studying what that increase should be. That’s one, but we need more regulation,” he added.

He said increasing taxes by around 10 percent, based on gross gaming revenue, could generate an additional PHP20 billion in government revenue annually.

Other proposed measures include banning government officials from participating in online gambling, placing warning labels about the risks of gambling, and using the national ID system to restrict access to users aged 21 and below.

“There should probably also be a warning that gambling is habit-forming, similar to cigarette labels. I think we need to have a system in place, and part of the regulation should include something like that,” Recto said.

“Maybe we can use the national ID, as I’ve suggested before, so that a person’s age can be verified. If you’re below 21, you shouldn’t be allowed to play online games.”

Recto also raised the possibility of requiring online gaming operators to publicly list their businesses for transparency.

“That’s a possibility. We can force them to list para alam natin (so we will know) who are the people behind it. It becomes more transparent. That’s a possibility,” he said. (PNA)

Leave a comment