MANILA — More bank depositors are now covered by government protection following the Philippine Deposit Insurance Corporation’s (PDIC) move to double the maximum deposit insurance coverage (MDIC) to P1 million per depositor, per bank starting March 15, 2025.

Based on PDIC data as of end-December 2024, the increase means 147 million deposit accounts are now fully insured—higher by almost 1.5 million accounts compared to coverage under the previous P500,000 MDIC. This brings the total share of fully insured accounts in the banking system to 98.6%, up from 97.6%.

In terms of amount, insured deposits have reached P5.3 trillion, or P1.3 trillion higher than under the old MDIC. The coverage now accounts for 24.1% of total deposits, compared to 18% previously.

The PDIC said the move was well received by banks and depositors. Consultation meetings held before the implementation drew support from key bank associations.

“It’s a timely move given that limits have not been increased in years,” said Bankers Association of the Philippines President Jose Teodoro Limcaoco.

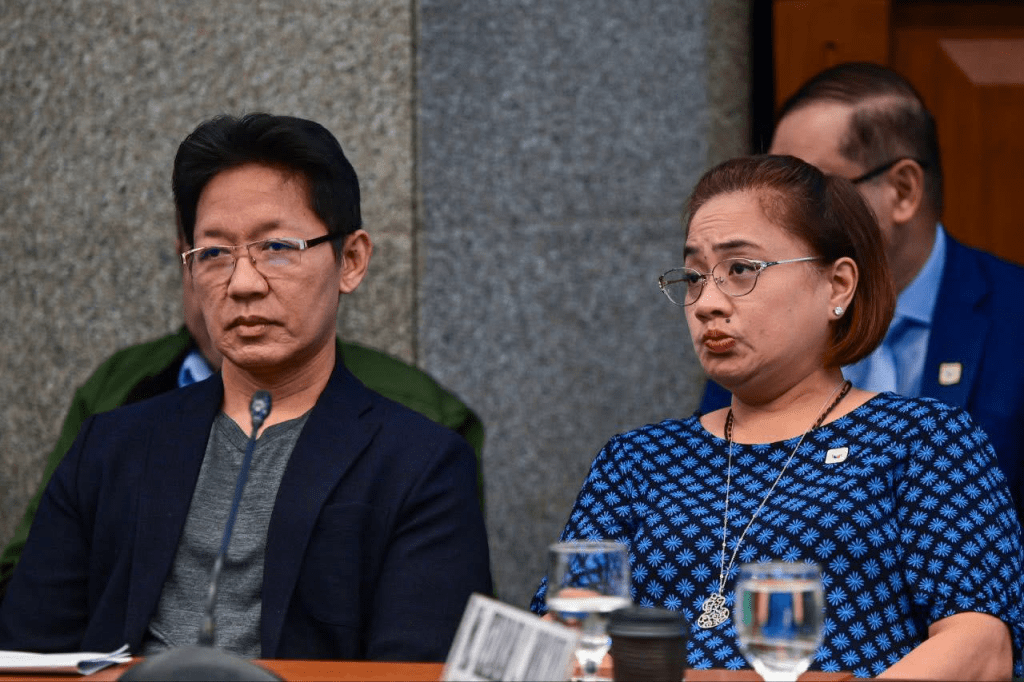

Chamber of Thrift Banks President Mary Jane Perreras said, “This move reinforces trust in the banking system, especially for senior citizens and retirees who rely on deposit security.”

Rural Bankers Association of the Philippines President Jose Paolo Palileo added, “This further strengthens public confidence in the banking system, and comes at no extra cost to insured banks, thereby allowing them to attract more private investment in the form of savings.”

The PDIC Board of Directors approved the adjustment pursuant to Republic Act No. 3591, as amended. It is the first increase in MDIC that did not require Congressional approval following recent amendments to the PDIC Charter.

The P1-million MDIC is based on a World Bank-recommended methodology aimed at restoring the 2009 value of the previous coverage, eroded by inflation.

According to the PDIC, the increase is a proactive move to “reinforce confidence in the Philippine banking system and contribute to financial stability.” The agency said the new MDIC will help protect savings, prevent panic withdrawals, and stabilize liquidity across banks.

The PDIC reiterated its commitment to depositor protection and financial stability through its insurance program and other initiatives as a co-regulator and receiver of closed banks.

Leave a comment