MANILA — The Supreme Court has clarified that companies registered under the Philippine Economic Zone Authority (PEZA) are not entirely exempt from paying Value-Added Tax (VAT), as it partially granted a refund claim filed by Coral Bay Nickel Corporation.

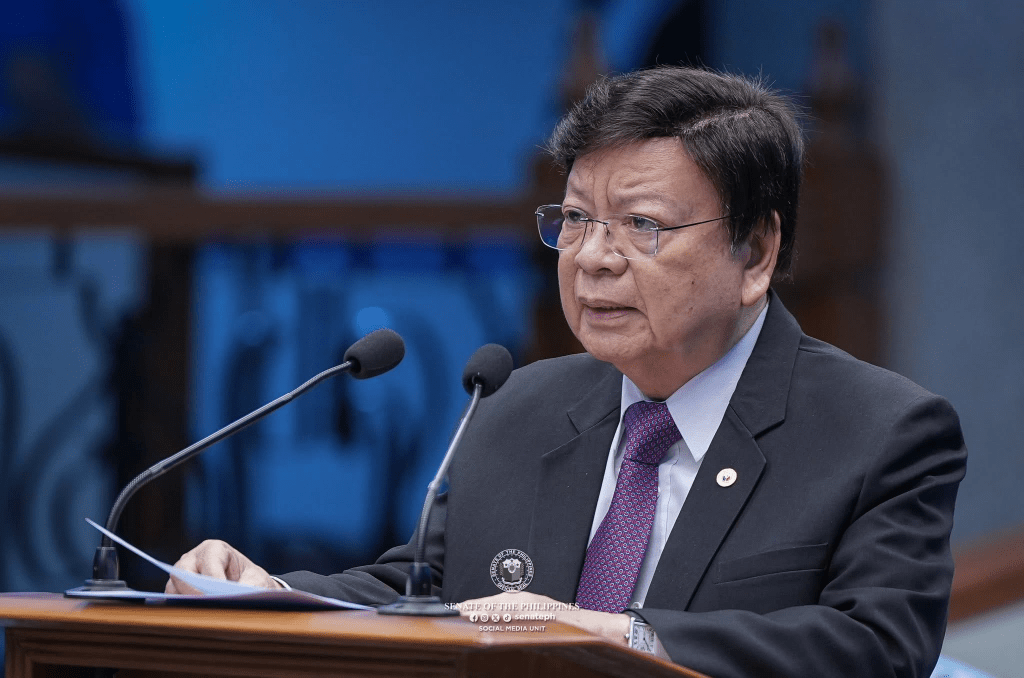

In a decision penned by Associate Justice Japar B. Dimaampao, the SC’s Third Division ruled in favor of Coral Bay, a PEZA-registered domestic enterprise engaged in manufacturing and exporting nickel and cobalt mixed sulfide. The company had sought a VAT refund for input VAT it paid on goods and services consumed outside the PEZA zone.

Coral Bay filed the refund claim with the Bureau of Internal Revenue (BIR), but the agency did not act on the request, prompting the company to bring the case to the Court of Tax Appeals (CTA). The CTA’s Third Division approved the refund but limited it to purchases proven to be consumed outside the ecozone, applying a sales-based allocation of input VAT.

The CTA En Banc later reversed the ruling, treating Coral Bay as fully VAT-exempt and therefore ineligible for any VAT refund since its purchases were considered zero-rated.

Coral Bay then appealed to the Supreme Court, which sided with the company.

Under Republic Act No. 7916 or the Special Economic Zone Act of 1995, PEZA-registered enterprises are exempt from national and local taxes, except for real property tax on land owned by developers, and instead pay a 5% tax on gross income. However, this exemption does not cover VAT.

The high court explained that while PEZA zones are treated as foreign territory under the “cross-border doctrine,” zero-rating only applies to goods or services used within the ecozone. When goods or services are consumed outside the ecozone but still within Philippine territory, the destination principle applies, and the transaction becomes subject to VAT.

In Coral Bay’s case, the Supreme Court ruled that the purchases in question were consumed outside the PEZA zone but within the country. As such, they are subject to VAT, making Coral Bay entitled to a refund for unutilized input VAT.

Leave a comment