MANILA — The Land Bank of the Philippines (LANDBANK) has committed ₱60 billion, or 60 percent, of the ₱100-billion syndicated term loan facility for the Power Sector Assets and Liabilities Management Corporation (PSALM).

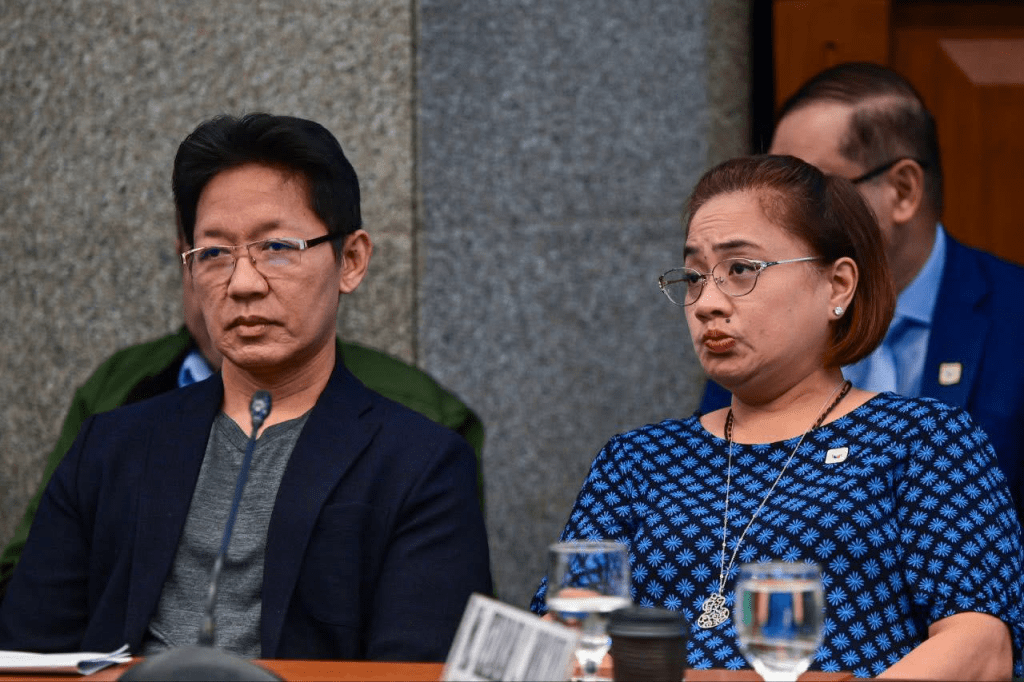

LANDBANK President and CEO Lynette V. Ortiz, PSALM President and CEO Dennis Edward A. Dela Serna, and Development Bank of the Philippines (DBP) President and CEO Michael O. de Jesus signed the agreement on July 17, 2025, in Quezon City. The signing was witnessed by Government Corporate Counsel Judge Solomon M. Hermosura.

The proceeds will be used to augment PSALM’s working capital, refinance existing liabilities, and settle domestic contractual obligations.

“We are honored to be part of this important milestone, alongside our partners in government and development finance. This transaction reflects our collective resolve to strengthening the Philippine power sector—an industry that is fundamental to shaping the future of our economy and uplifting the lives of every Filipino,” Ortiz said.

LANDBANK and DBP served as Joint Lead Arrangers of the syndicated deal, with LANDBANK–Trust Banking Group as Facility and Paying Agent, and the Office of the Government Corporate Counsel (OGCC) as Transaction Counsel.

The loan will support PSALM’s mandate under the Electric Power Industry Reform Act (EPIRA), which covers the management, privatization, and liquidation of the remaining assets and obligations of the National Power Corporation.

LANDBANK has partnered with PSALM since 2008, providing financing support for its programs, while also funding major players in the energy industry such as oil companies, power producers, and distribution utilities.

Leave a comment