DAVAO CITY — The Philippine Deposit Insurance Corporation (PDIC), in partnership with the Philippine Information Agency (PIA) Davao Regional Office, held a regional press conference on Friday to raise awareness on deposit insurance through its “PDIC 101: Understanding Deposit Insurance” initiative.

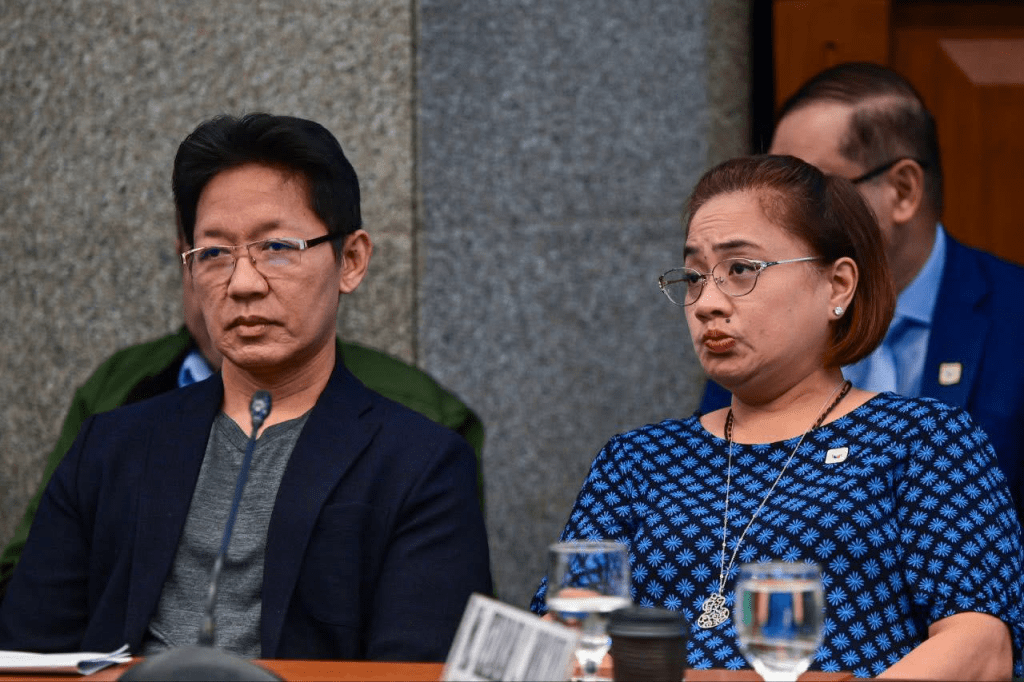

The event, facilitated by PDIC Vice President Jose G. Villaret Jr. of the Corporate Affairs Group, brought together local media representatives from television, radio, print, and online networks for discussions on the mandates of the PDIC and the benefits and limitations of deposit insurance.

Villaret underscored the PDIC’s role in protecting depositors and highlighted the increase in the maximum deposit insurance coverage (MDIC) to P1 million per depositor, per bank, which took effect on March 15, 2025.

As the state deposit insurer, the PDIC manages the Deposit Insurance Fund that serves as the source for paying deposit insurance in the event of bank closures ordered by the Bangko Sentral ng Pilipinas (BSP). It also acts as co-regulator of banks and as statutory receiver of closed banks to administer liquidation processes.

The initiative aims to equip media practitioners with accurate information so they can act as “agents of information to help spread this awareness to more people through their respective platforms and networks,” the PDIC said.

The Davao leg marked the third regional run of PDIC 101 this year, following similar sessions in Naga City in May and Cebu City in July.

The PDIC said its collaboration with the PIA, which began in 2024, supports efforts to promote financial literacy, the benefits of saving in banks, and the protection provided by deposit insurance as part of the government’s financial inclusion program.

For more information, the public may visit www.pdic.gov.ph or the official PDIC Facebook page.

Leave a comment