MANILA – President Ferdinand R. Marcos Jr. has signed the Enhanced Fiscal Regime for Large-Scale Metallic Mining Act (Republic Act 12253), which sets a fairer and more transparent tax system for the mining industry.

Under the new law, mining companies operating within government-designated mineral reservations must pay a royalty equivalent to 5 percent of their gross output. Those operating outside mineral reservations will be subject to a margin-based royalty on income from their operations.

The law also introduces an additional tax on companies with profit margins exceeding 30 percent, ensuring that the government captures a bigger share of windfall profits for the benefit of affected communities and the Filipino people.

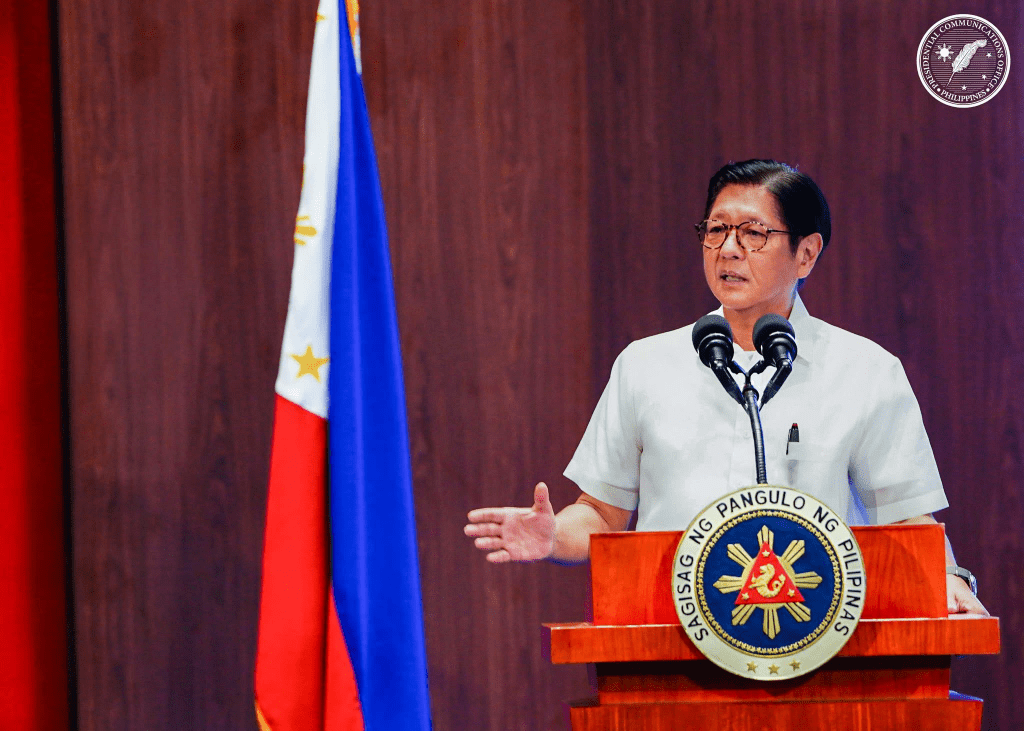

“With the signing of the Enhanced Fiscal Regime for Large-Scale Metallic Mining Act, we are putting into place a system that is fairer, clearer, and more responsive to the needs of both our people and the environment,” Marcos said during the ceremony at Malacañang Palace.

He emphasized that the measure will simplify the system for managing mining revenues, guarantee the government’s rightful share, uphold transparency, and provide security to investors.

The President noted that global demand for critical minerals is surging, and the Philippines—rich in such resources—must ensure that its mining framework is strong and beneficial to Filipinos.

“When the world needs these minerals, then we must make sure that our mining infrastructure is robust and that Filipinos, above all, benefit from it,” Marcos said.

The new regime also prevents mining companies from consolidating income and expenses across multiple projects by recognizing each contractor as a separate taxable entity, tightening revenue collection.

Leave a comment