MANILA — The Philippine Deposit Insurance Corporation (PDIC) and Land Bank of the Philippines (LandBank) have signed a memorandum of agreement (MOA) to implement the LandBank Bulk Credit System (LBCS), a new digital facility designed to speed up the settlement of claims from creditors of closed banks.

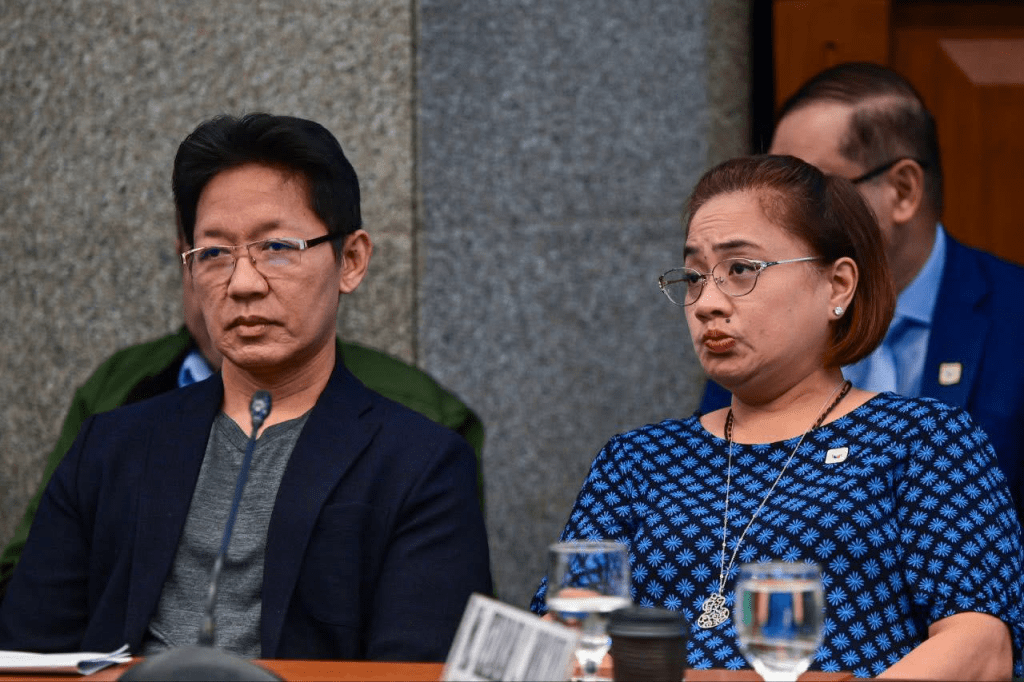

The agreement, sealed on July 21, 2025, at the PDIC Chino Building in Makati City, was led by PDIC President and CEO Roberto B. Tan and LandBank President and CEO Lynette V. Ortiz.

The LBCS replaces traditional manual processes with a web-based platform capable of handling high-volume electronic fund transfers in a single transaction. Integrated with national payment systems such as PESONet and InstaPay, the facility allows same-day or real-time crediting of funds while removing the need for paper checks and cash handling.

“This initiative not only strengthens our operational capabilities but also reinforces our shared commitment to public service and financial inclusion,” Tan said, emphasizing that the innovation builds on a longstanding partnership between PDIC and LandBank.

The LBCS is the fourth settlement facility developed through the collaboration of the two institutions. Previous initiatives included the issuance of manager’s checks (2012), direct crediting to LandBank deposit accounts, payment through the Link.BizPortal (2023), and the Visa Debit Card facility (2024).

PDIC said the new payment option reaffirms its mandate to protect depositors and strengthen public trust in the financial system by ensuring that closed bank creditors receive their claims promptly and securely

Leave a comment