MANILA — Weak enforcement and governance lapses, not high tobacco taxes, are fueling the Philippines’ illegal cigarette trade, according to a nationwide study by Action for Economic Reforms (AER) and Economics for Health of the Johns Hopkins Bloomberg School of Public Health.

The study, which surveyed over 1,000 sari-sari stores and audited more than 7,500 cigarette packs in eight key cities, found that Southern Mindanao—particularly Zamboanga and General Santos—had the highest prevalence of illicit tobacco trade. In Zamboanga City alone, nearly 80 percent of cigarette packs were sold below applicable taxes, while up to 96 percent had fake or missing tax stamps.

In contrast, the study noted that illicit cigarette sales in Luzon, Visayas, and Metro Manila remain low.

“The results disprove the tobacco industry’s narrative that high taxes cause smuggling,” said Daffodil Santillan, AER lead researcher for the study. “The evidence shows the real issue is weak law enforcement and regulatory oversight, especially at ports and borders. Lowering tobacco taxes will only make cigarettes cheaper and Filipinos sicker.”

The study emphasized that tobacco excise tax rates—applied uniformly across the country—cannot explain the regional disparities in smuggling. It instead pointed to local political will, maritime governance, and enforcement intensity as the key determinants of where illicit products proliferate.

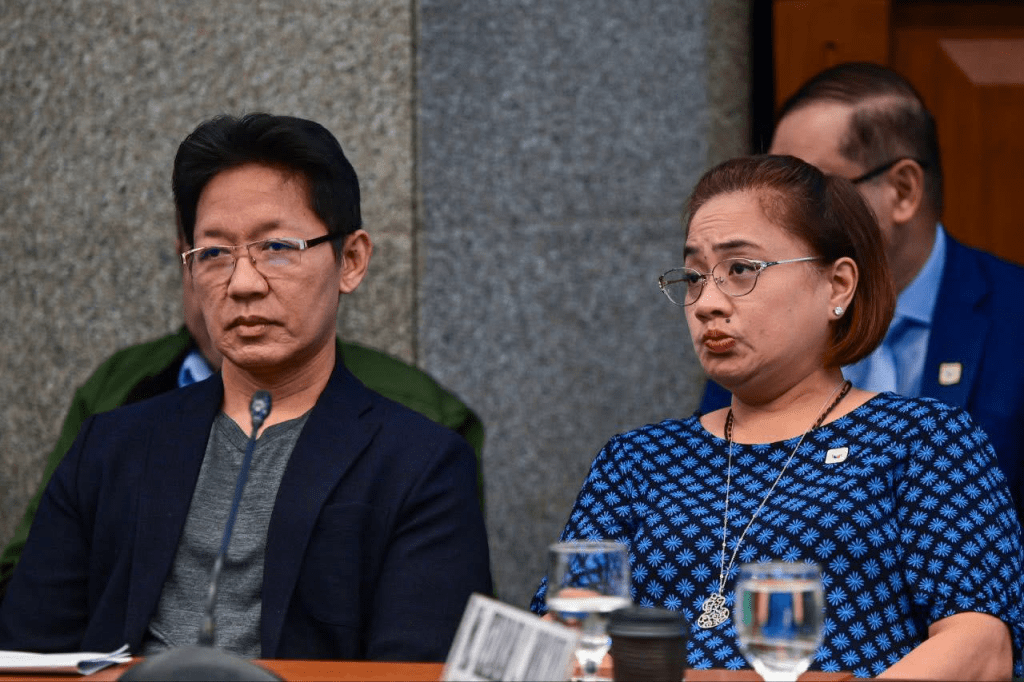

Zamboanga City Vice Mayor Beng Climaco, who spoke at the launch of the study, highlighted the importance of strong local action against smuggling. “During my term as Zamboanga City Mayor, I led an uncompromising campaign against smuggling in Zamboanga City, initiating investigations into Customs officials and over the disappearance of smuggled sugar and rice from warehouses, demanding full accountability,” Climaco said. “As Regional Peace and Order Council Chair for two terms, I also coordinated with law enforcement agencies down to the Barangay and personally oversaw midnight operations and confiscations, underscoring my firm resolve to protect the city from illicit trade and corruption.”

AER called on the government to reject pending proposals that seek to reduce tobacco excise taxes, such as House Bill 11360, which was passed earlier this year with limited deliberation. The group also opposed House Bills 5207, 5212, and 5364, which propose lower taxes on vape and heated tobacco products.

AER warned that these measures would undo more than a decade of progress in reducing smoking rates and raising health revenues. Since 2012, tobacco tax reforms have helped cut adult smoking prevalence from 29.7 percent in 2009 to 19.5 percent in 2021, while boosting funding for health programs.

To curb illicit trade and protect tax reform gains, AER recommended upgrading the current tax stamp system into a modern track-and-trace mechanism with physical and digital markers. It also urged the government to license all tobacco retailers, empower the Bureau of Internal Revenue (BIR) to close noncompliant establishments, and strengthen coordination among Customs, the BIR, and local governments in enforcement hotspots.

“Tobacco tax reforms save lives and fund the healthcare of the most vulnerable Filipinos,” said Senator Risa Hontiveros, Chair of the Senate Committee on Health and Demography. “It’s time to protect public health and public revenues through stronger enforcement. Lowering taxes at this point, when our economy is struggling and [the] government needs revenues, may not be a good idea.”

The report, titled Illicit Tobacco Trade in the Philippines: Findings from Sari-Sari Store Surveys and Empty Pack Audits, was validated by the Bureau of Internal Revenue and is available on AER’s website at aer.ph.

Leave a comment